Economies grow and recede. Recently, people have related economic recessions to bursting bubbles. In 2001, the United States saw the Dot Com bubble burst, and in 2008, there we saw the housing bubble burst. The ebbs and flows have been a part of every economy since people started keeping track of economic data. But why does this happen?

Depending on which economic school of thought you prefer, you can have many different answers. Communists might argue that recessions are caused by capitalists acting in their own self-interest and taking advantage of the working class. For example, in 2008, banks were giving loans to people who could not afford to pay them back. When people stopped paying the loans back, money that was relied on was not there, and the economy suffered.

While this explanation of recessions (which can be summed up in one word: greed), is a catch-all for an incredibly complex economic dynamic that occurred over several years, it is not adequate. A real look into the business cycle would explain not just how the past recession occurred, but why recessions will continue in the future.

Crash Course and Keynesianism

We mentioned before how Crash Course, while admitting that there are different theories for economic phenomena, favors one in particular for macroeconomics: Keynesianism.

To be fair, the Keynesian explanation of the business cycle is also what is taught in your average economic textbook, so we shouldn’t be too surprised. It is explained in the video using the common analogy of a car:

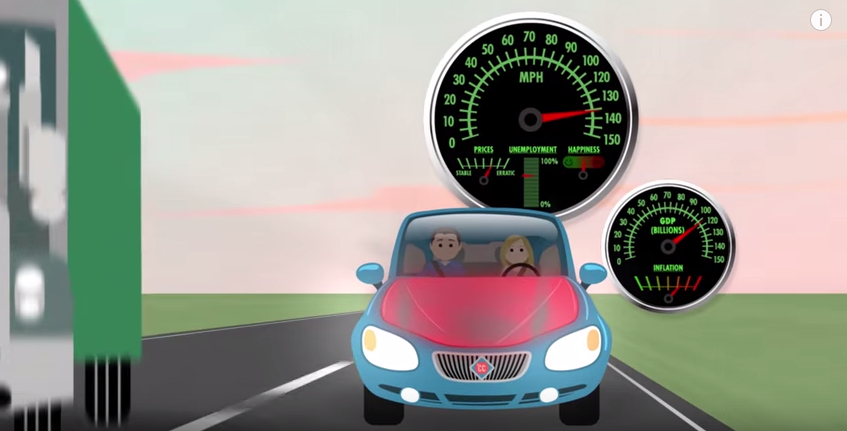

If we imagine the economy as a car, then GDP, employment, and inflation are gauges. A car can cruise along at 65 miles per hour without overheating. Safe cruising speed is like full employment; unemployment is low, prices are stable, and people are happy.

But if we drive that car too fast for too long, it’ll overheat. In an economy significant spending increases GDP, causing an expansion. Unemployment falls and factories start producing at full capacity to keep up with demand.

Since the amount of products that can be produced is limited, people start to outbid each other, resulting in inflation. Eventually, production costs increase as workers demand higher wages and the economy starts to slow down. Businesses lay off a few workers. Those workers spend less, causing the businesses that produce the goods that they would otherwise buying to lay off more workers.

This is a contraction. The economy is going too slow. Eventually things stabilize, production costs fall as resources are sitting idle, and the economy starts to expand again. This process of booms and busts is called the business cycle.

A lot of this explanation is fluff, but the essential explanation of the business cycle can be cut down to the following:

People start to outbid each other [for resources], resulting in inflation. Eventually, production costs increase as workers demand higher wages and the economy starts to slow down.

Essentially, the price of raw materials increases, and workers demand higher wages. The combination of the two hurts business, which starts the downturn. Let’s take a look at these two separately:

1. Increase in the Price of Raw Materials

Resources are scarce, and businesses have to compete for these resources. When businesses are doing well and demand more of these scarce resources, the price must increase, since the supply cannot increase. The increased price weakens the businesses.

But businesses can also forecast the prices of raw materials. In fact, many businesses hire people to do exactly that. Rising prices like these should come as no surprise to businesses, and if they are expected, they would be accounted for in a way that minimizes damage to the business.

Additionally, rising prices in the provision of raw materials would signal to the market that more resources need to be devoted to it. The raw materials business is booming in this scenario, so the industry would be hiring workers as the demand for their resources increases. The market would be shifting jobs from one area of the economy to another, which is normal. I don’t see how unemployment results from this.

2. Workers Demand Higher Wages

This is a huge assumption: over time, workers demand higher wages, so employers choose to increase wages, and have to lay off some workers as a result.

This just doesn’t happen. An employer will usually do what’s good for the business, and if it’s a large company with shareholders, the owner has a fiduciary duty to do what’s good for the business. In other words, if the CEO of a company knowingly does something that will hurt the business, he/she gets sued.

Sometimes, employees are paid less than what the employer would pay, and the demand for higher wages results in higher wages. This often happens in a boom economy: employees have many job options, forcing employers to pay them more to keep them at their current job. But if the employer cannot afford to give higher wages (and we know this because increasing wages would result in lay offs), he won’t, and in many cases, he legally cannot.

Wages are determined by the amount of value created, how much the employer is willing to pay, and how much the worker is willing to work for. The worker’s demands alone does not determine his/her pay, and businesses likely will not weaken themselves because the employees ask it.

3. The Spending Spiral Takes Care of the Rest

While the cause of the downturn is debatable, Crash Course’s explanation of the result is rather accurate. Once businesses start losing money, they start laying off workers, who spend less in the economy, so everybody hurts.

Please note that this is a different situation from that my last post, where money is shifted from spending to saving. In the current case, spending and saving is replaced with nothing.

The Role of Government

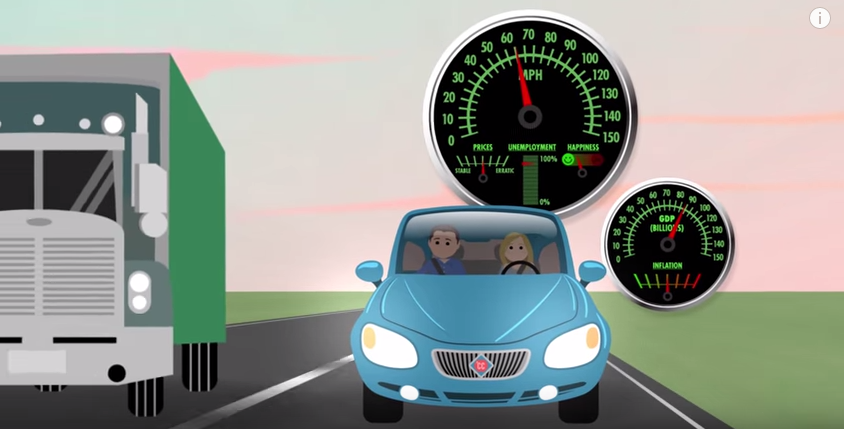

According to Crash Course (and many economics textbooks), the above explanation is what naturally happens in a free market economy, and economists generally favor the government to step in to fix it (again using the car analogy):

When I’m driving my car on the highway I like to use cruise control to regulate my speed. So why don’t we have cruise control for the economy? Well, many economists think that the government should play a role in speeding up or slowing down the economy. For example, when there’s a recession, the government can increase spending or cut taxes so consumers have more money to spend.

Proponents of this policy argue that it would get the economy back to full employment, but it has its drawback: debt.

Increasing spending or decreasing taxes (absent other changes) would increase the debt, which Crash Course will get into in another video.

My problem is the assumption that government must have nothing to do with the cause of the recession; it is only shown as the possible solution.

Crash Course Criticism will get into alternative business cycle theories and the other possible causes of recessions when we get to the videos on the Federal Reserve. We have a lot to talk about here. Stay tuned.

Like what I wrote? Hate it? Drop some feedback in the comments.