Man, was I wrong. I now have no idea how Crash Course plans to schedule the release these videos. After a gap of over 2 weeks before episode #5, they release #6 just four days later. I’ll try to find the answer and let you know ASAP. I know you value predictability, and so do I.

Month: August 2015

The Business Cycle, Crash Course Episode #5

Economies grow and recede. Recently, people have related economic recessions to bursting bubbles. In 2001, the United States saw the Dot Com bubble burst, and in 2008, there we saw the housing bubble burst. The ebbs and flows have been a part of every economy since people started keeping track of economic data. But why does this happen?

Depending on which economic school of thought you prefer, you can have many different answers. Communists might argue that recessions are caused by capitalists acting in their own self-interest and taking advantage of the working class. For example, in 2008, banks were giving loans to people who could not afford to pay them back. When people stopped paying the loans back, money that was relied on was not there, and the economy suffered.

While this explanation of recessions (which can be summed up in one word: greed), is a catch-all for an incredibly complex economic dynamic that occurred over several years, it is not adequate. A real look into the business cycle would explain not just how the past recession occurred, but why recessions will continue in the future.

Crash Course and Keynesianism

We mentioned before how Crash Course, while admitting that there are different theories for economic phenomena, favors one in particular for macroeconomics: Keynesianism.

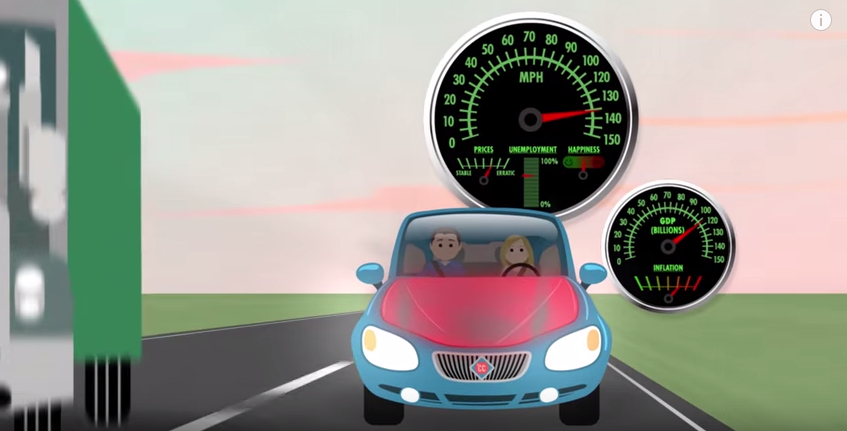

To be fair, the Keynesian explanation of the business cycle is also what is taught in your average economic textbook, so we shouldn’t be too surprised. It is explained in the video using the common analogy of a car:

If we imagine the economy as a car, then GDP, employment, and inflation are gauges. A car can cruise along at 65 miles per hour without overheating. Safe cruising speed is like full employment; unemployment is low, prices are stable, and people are happy.

But if we drive that car too fast for too long, it’ll overheat. In an economy significant spending increases GDP, causing an expansion. Unemployment falls and factories start producing at full capacity to keep up with demand.

Since the amount of products that can be produced is limited, people start to outbid each other, resulting in inflation. Eventually, production costs increase as workers demand higher wages and the economy starts to slow down. Businesses lay off a few workers. Those workers spend less, causing the businesses that produce the goods that they would otherwise buying to lay off more workers.

This is a contraction. The economy is going too slow. Eventually things stabilize, production costs fall as resources are sitting idle, and the economy starts to expand again. This process of booms and busts is called the business cycle.

A lot of this explanation is fluff, but the essential explanation of the business cycle can be cut down to the following:

People start to outbid each other [for resources], resulting in inflation. Eventually, production costs increase as workers demand higher wages and the economy starts to slow down.

Essentially, the price of raw materials increases, and workers demand higher wages. The combination of the two hurts business, which starts the downturn. Let’s take a look at these two separately:

1. Increase in the Price of Raw Materials

Resources are scarce, and businesses have to compete for these resources. When businesses are doing well and demand more of these scarce resources, the price must increase, since the supply cannot increase. The increased price weakens the businesses.

But businesses can also forecast the prices of raw materials. In fact, many businesses hire people to do exactly that. Rising prices like these should come as no surprise to businesses, and if they are expected, they would be accounted for in a way that minimizes damage to the business.

Additionally, rising prices in the provision of raw materials would signal to the market that more resources need to be devoted to it. The raw materials business is booming in this scenario, so the industry would be hiring workers as the demand for their resources increases. The market would be shifting jobs from one area of the economy to another, which is normal. I don’t see how unemployment results from this.

2. Workers Demand Higher Wages

This is a huge assumption: over time, workers demand higher wages, so employers choose to increase wages, and have to lay off some workers as a result.

This just doesn’t happen. An employer will usually do what’s good for the business, and if it’s a large company with shareholders, the owner has a fiduciary duty to do what’s good for the business. In other words, if the CEO of a company knowingly does something that will hurt the business, he/she gets sued.

Sometimes, employees are paid less than what the employer would pay, and the demand for higher wages results in higher wages. This often happens in a boom economy: employees have many job options, forcing employers to pay them more to keep them at their current job. But if the employer cannot afford to give higher wages (and we know this because increasing wages would result in lay offs), he won’t, and in many cases, he legally cannot.

Wages are determined by the amount of value created, how much the employer is willing to pay, and how much the worker is willing to work for. The worker’s demands alone does not determine his/her pay, and businesses likely will not weaken themselves because the employees ask it.

3. The Spending Spiral Takes Care of the Rest

While the cause of the downturn is debatable, Crash Course’s explanation of the result is rather accurate. Once businesses start losing money, they start laying off workers, who spend less in the economy, so everybody hurts.

Please note that this is a different situation from that my last post, where money is shifted from spending to saving. In the current case, spending and saving is replaced with nothing.

The Role of Government

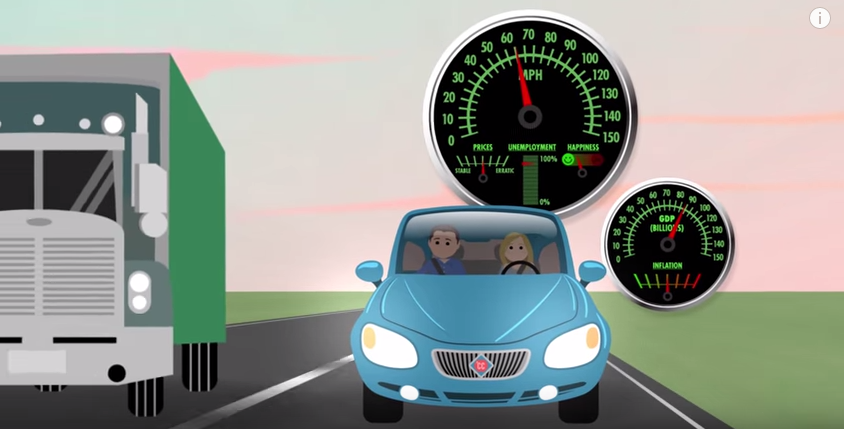

According to Crash Course (and many economics textbooks), the above explanation is what naturally happens in a free market economy, and economists generally favor the government to step in to fix it (again using the car analogy):

When I’m driving my car on the highway I like to use cruise control to regulate my speed. So why don’t we have cruise control for the economy? Well, many economists think that the government should play a role in speeding up or slowing down the economy. For example, when there’s a recession, the government can increase spending or cut taxes so consumers have more money to spend.

Proponents of this policy argue that it would get the economy back to full employment, but it has its drawback: debt.

Increasing spending or decreasing taxes (absent other changes) would increase the debt, which Crash Course will get into in another video.

My problem is the assumption that government must have nothing to do with the cause of the recession; it is only shown as the possible solution.

Crash Course Criticism will get into alternative business cycle theories and the other possible causes of recessions when we get to the videos on the Federal Reserve. We have a lot to talk about here. Stay tuned.

Like what I wrote? Hate it? Drop some feedback in the comments.

Deflation, Episode #5: Macroeconomics

This episode of Crash Course was a major one: Macroeconomics. This is the big picture of economics, and as the hosts accurately mention in the beginning of the video:

If you ask three economists the same question, you are likely to get three different answers. “But how,” you ask, “can the dismal science be so subjective? Well, economics is not a traditional science because it’s nearly impossible to control all the different variables like all the social sciences.

Way ahead of you, Crash Course. Economics is not like physics, and the lack of variable controls frustrates everyone.

While Crash Course correctly notes that economics is pretty subjective, they do not hesitate to claim some debatable economic theories as fact.

Deflation

When prices fall, everyone is happy, except some economists (including those at Crash Course):

Deflation seems like it would be a good thing, but most economists see falling prices as a bad thing. Falling prices actually discourage people from spending since they might expect prices to fall more in the future.

Less spending in the economy means GDP is going to decrease and unemployment is going to increase, and that becomes a vicious cycle. So severe recessions are actually accompanied by deflation because the demand for goods and services falls.

There’s a lot to unpack here, so let’s go through a couple main points they make:

1. Falling prices makes people expect prices to fall more in the future

When a consumer sees a lower price, he might think three things: 1. The price is low and will continue to get lower 2. The price is low and will stay that way, and 3. The price is low only temporarily, and the price will increase in the future.

The fear of deflation relies on only option 1 being true, and the other two options not being true. While I can see option 1 as being a possibility, I have yet to hear an explanation of why the other two options could not also occur. People perceive falling prices in different ways; why do we assume that everyone will assume that prices will continue to fall? If the economy is an enormous complexity to most people, why do we assume they they will be able to accurately predict the future economy? Professional economists can’t even do that!

But let’s even say that number one is true, and people will expect prices to fall.

2. When people expect prices to fall, they will not buy products now

Every year, there are a number of products that people expect to get cheaper in the future:

How much will the new iPhone cost when it is released next month, and how much do you think it will cost a year from now? Does this stop people from getting the iPhone as soon as it comes out?

Clothing companies release a new season’s collection, and nearly all of the clothes will be on sale within the next two to three months. Does that stop people from buying the clothes as soon as they come out?

People still buy products, even when it’s a near-certainty that it will be cheaper in a couple months. Some people do hold out for prices to fall, but does this collapse the industry when new products are released?

3. If people reduce spending, the economy will suffer

If people decide to put money in the bank and wait, instead of spending money now, what happens? Certain industries do suffer, namely those in the business of providing consumer goods as opposed to capital goods. Simply stated, consumer goods are the stuff you buy to enjoy, and capital goods are the goods that are used to make consumer goods, such as machinery to make products, buildings to house companies, etc.

So when you decide to save, consumer goods places like Amazon, Disney World, and your favorite Italian restaurant will suffer, but does that mean that the entire economy will do poorly?

Where Does Saved Money Go?

When you put money in the bank, it doesn’t just sit there. Banks lend out their money to people and business who eagerly want to spend that money for themselves (to buy a house, for example) or business. Your money in the bank actually ends up going to those who are the most eager to spend it (and are likely to pay the bank back).

So saving does not weaken the economy; it merely shifts the economy toward capital goods instead of consumer goods. Wal-Mart may contract, but steel and construction companies will prosper, and jobs will move from the former to the latter.

Less overall spending is generally an effect of a bad economy, not the cause. People being laid off have both less to spend and less to save, but it is not their original saving that caused the economy to bust.

Nonetheless, there are times when there is high unemployment, and businesses cut jobs without other jobs opening in different parts of the economy. If less spending doesn’t cause the economy to weaken, then something else must be the cause. We will get to that when we look at Crash Course’s explanation of the Business Cycle.

Episode #5 is Here

Take a look and tell me what you think upon first watch. While the show’s creator didn’t respond to me, it looks like they are releasing episodes every two weeks, which means this series will be going on for nearly 18 months. Crash Course Criticism will be here until the end!

-Gary

“The Market is Not Awesome,” Episode #4

In the first two-thirds of the fourth episode of Crash Course Economics, the hosts explained that supply and demand do the best job of sending signals to consumers and businesses on how much people want something and how much of it there is. The hosts use the examples of strawberries and oil to communicate how these ideas work in real life.

The Fire Department

It seems like the hosts love how markets almost-magically satisfy consumer demand, but only to an extent:

So markets and supply and demand are awesome. But sometimes, they’re not awesome. For example, we don’t want to use the market approach when it comes to firefighters.

This is a common argument: the market is great to an extent, but there are some things that the market is not good for. Since Crash Course came out strongly against government subsidies of businesses (and did an excellent job of explaining it, in my opinion), I was prepared to hear a thorough explanation of why we should forget what they said before, and favor a completely government-funded service instead of the market. Instead of an explanation, Crash Course gave a doomsday characterization of what a privatized firefighting service would look like:

9-1-1, what’s your emergency?

-My house is on fire! How much do you charge to put it out?

It’ll be $10,000, what’s your credit card number?

-They’re all melted!

This probably goes without saying, but because of the infrequent and catastrophic nature of house fires for a household, a privatized fire department would almost certainly charge as an insurance-based system, not a pay-for-it-when-I-need-it service. People privately purchase the same protection for medical and automotive problems (not to mention damage recovery insurance against floods and even death itself), so why not fires?

Unfortunately, Crash Course’s only argument presented was that a privatized fire department would charge too much for its service, and therefore the market wouldn’t work. Or maybe Crash Course is arguing that business would take advantage of desperate consumers whose houses are burning and charge them an unfair price. Besides laws voiding contracts under duress (which would likely be the case here), Crash Course would do well to remember what they argued just minutes before:

As Crash Course argued earlier in the video, the market could certainly provide a suitable price and system for most (if not all) goods and services, fire department included.

The Organ Market

Crash Course brings up an even bigger subject with the example of buying and selling organs, a practice that is prohibited in the United States. This piece of the video strays a bit from economics and delves more into philosophy and morality:

What about the market for human organs? After all, there’s a huge shortage, and thousands of people die each year waiting for transplants. Should there be a competitive market for human kidneys?

A free marketeer would say “sure, why not? If a donor wants $15,000 more than he wants his other kidney, why stop him?”

Well, ethics. I mean, there are several problems that arise in an unregulated market for human kidneys. First is the moral question: is it fair for a poor person who can’t afford a kidney to die while a rich person lives? Well…no not at all!

Not to be the bearer of bad news, but we already live in a world where rich people survive in situations where poor people do not, including organ donations. Rich people can travel to other countries to get organ transplants, while poor and even middle class people cannot.

The question is: should more people have access to a service, even if not everyone would be able to have access to the service? Should this only apply to organ transplants or all medical services in general? What about in health-related areas like nutrition and safety? Should certain goods and services be prohibited because some can afford them and others cannot?

Another problem results in the law of supply. When there’s an increase in the price of kidneys, there’s an incentive for people to steal and sell kidneys.

First of all, legalizing the sale of kidneys would decrease the price of kidneys, since the current price can only be found at high, black market rates. Second, I imagine that doctors and hospitals would have some standards that would prevent someone from walking into a hospital with a bag of organs to be used for transplants. Hospitals (and if not, governments) would be able to set the standards to prevent stolen organs from entering the legal transplant system.

Currently, you can sell your blood or plasma for money. Is Crash Course concerned that people will steal and sell blood or plasma?

There may be a good argument against the voluntary buying and selling of organs, but I don’t think it’s in this video. If you do have a good argument against it, please drop it in the comments.

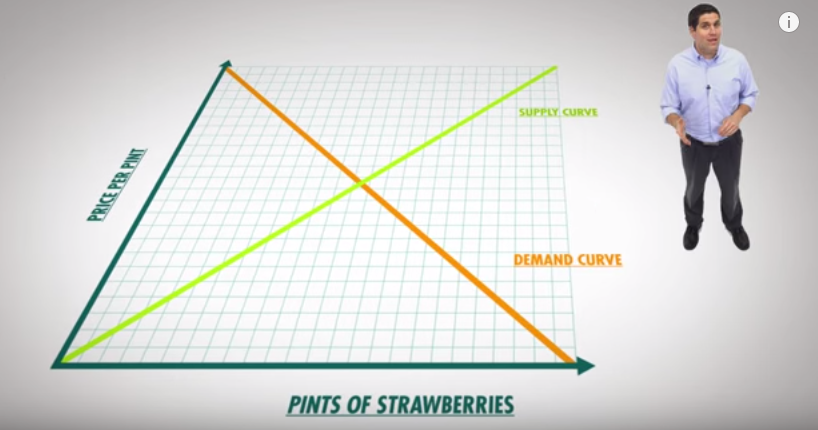

The Supply/Demand Graph, Episode #4

The Graph

Crash Course’s explanation of Supply and Demand is pretty spot on. Most economic schools (all but Marxism as far as I know) agree that the equilibrium price is reached where the demand and supply curves meet. The demand curve is determined by how much money buyers would be willing to pay for a product, and the supply curve is determined by how cheap of a price sellers would sell a product.

Marxists, however, believe in the Labor Theory of Value, and would probably reject the the graph entirely. The Labor Theory of Value states that a product’s value is determined by the amount of labor required to produce it, so if a product takes someone 1 hour to make and a different product takes 5 hours, then the second product must be more economically valuable.

(courtesy of SMBC Comics)

Government Subsidies

Crash Course notes correctly that the concept of “fairness” or “the right price” is subjective and is not based in economics:

Some people might want to talk about a price being fair or right, but that all depends on your point of view. The buyer always considers a low price to be a fair price, while the seller considers it unfair and vise versa. In general economists don’t really like to push opinions about prices. Voluntary exchange suggests that the price is there for a reason.

However, immediately after this, they input a little bit of their personal bias when they argue against government subsidies for business who are hurting because of low demand:

For example, assume the demand for strawberries inexplicably falls, so the demand curve shifts to the left, and the equilibrium price and quantity fall. Farmers might go to the government for assistance, but most economists argue there is no reason to bail them out. The market has spoken: strawberries are so over.

While I agree with their position, it’s little awkward to give a policy position immediately after saying that economists don’t like to push opinions. As I’ve noted previously, the market sometimes shifts jobs from one industry to another, and those who argue in favor of corporate subsidies are usually ones the who are afraid of having to change jobs.

But economists are correct in saying that the government should not bail out industries, because it would do a net harm to the population generally, even if it helps a sector. Crash Course acknowledges this when they say:

If the government helps the farmers by giving them a subsidy, it would be putting resources toward something that society doesn’t value. That would be inefficient.

Here I do wish Adriene would have mentioned what the most efficient way to use the resources would be: by not taking it from people in the first place. Since the market (i.e. people spending their own money freely) is the most efficient method of choosing what society wants, why do resources need to be taken from the market in the first place?

Markets and Efficiency, Episode #4: Supply and Demand

After a very long break from the previous video (over 2 weeks), Crash Course released their fourth part of the economics series. This video was on supply and demand, and in this blogger’s opinion, contained both good and bad points.

What are Markets?

Crash Course begins the episode with defining what a market is:

A market is any place where buyers and sellers meet to exchange goods and services. The key to markets is the concept of voluntary exchange, that is that buyers and sellers willingly decide to make a transaction.

Let’s say you go to a farmer’s market and you buy a box of strawberries for $3. You value the box of strawberries more than the $3 you gave up to get it. The seller valued the $3 more than the box of strawberries. The transaction is a win-win because you got your strawberries and the farmers got their money.

This is a great point, but it’s not something too many people would disagree with. Crash Course’s really bold move came when they carried the principle of voluntary exchange to the labor market:

This same process happens in the labor market. Say that instead of the farmer’s market, you got your strawberries at the local supermarket. The cashier voluntarily decided to work there. He values the $10 an hour he makes there more than he does sitting at home, watching The Walking Dead. At the same time the owner of the store values the labor of the cashier more than the $10 an hour she pays him, and so it goes on and on up the chain of production, from the the driver that delivered the strawberries to the farmer that grew the strawberries to the tractor that the farmer purchased.

I say this is bold not because it’s wrong (I think it’s correct), but because it implicitly argues against the minimum wage, which prevents two people from making a voluntary exchange for labor that is less than than the decided minimum. The arguments in favor of a minimum wage state that some voluntary exchanges (in this case, labor for a cheaper price) do not make both parties better off, and it should be made illegal. In fact, some argue that these exchanges are in fact not voluntary at all and should be called “wage slavery,” which upon first listen, sounds pretty oxymoronic (i.e. slaves get wages?).

Efficient Markets

Crash Course also remarks on the efficiency of the market system:

Competitive markets turn out to be pretty great about allocating and distributing our scarce resources towards their most efficient use.

If farmers produced too many strawberries, then the price will fall as sellers try to sell them off. Lower prices means less profit to strawberry farmers, and those farmers will have an incentive to produce something else, like lettuce or brussels sprouts.

If farmers don’t produce enough strawberries, buyers will bid up the price and the farmers will have an incentive to produce more, which then drives down the price, and that’s like magic, except it’s not.

Very true, but I wish the video would have addressed the common arguments of central-planning advocates, namely when they believe that sellers charge too high of a price (which they refer to as “price gouging”) or too low of a price (which they refer to as “predatory pricing”). Even Mr. Clifford himself said that sometimes markets get things wrong, so why wouldn’t this be an example?

Crash Course may have given an answer to these objections in the current episode, albeit indirectly:

Businesses, and in particular large corporations, are often villainized as greedy, heartless institutions, that take advantage of consumers, but, if markets are transparent and buyers are free to choose, then businesses will have a hard time taking advantage of people.

In other words, prices are determined not to defraud or take advantage of the consumers, but because enough consumers value that product at that particular price.

Mr. Clifford even concludes this part of the video with a somewhat-snarky stab at general free market opponents:

If you really don’t like the policies or practices of a particular company, then don’t shop there. After all, in the free market, every dollar that is spent signals to producers what should be produced and how it should be produced.

This first part of the video was mostly great, stay tuned for future posts on the not-so-great parts of this video. Feel free to drop your thoughts on the video (or my critique of it) in the comments.