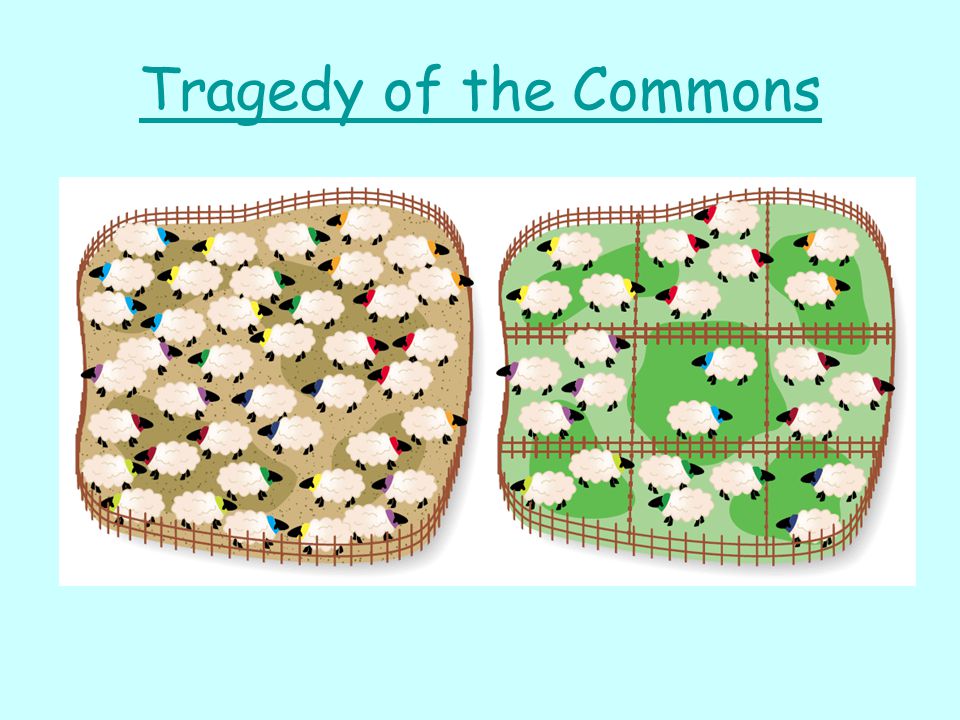

In this week’s episode, Crash Course covers the topic of Environmental Economics. Unfortunately, this episode mostly repeats the same economic lessons taught in the previous two episodes, making this week more of a bottle episode than anything else. We’ve already covered Crash Course’s points on externalities and tragedy of the commons, but we will touch on some new concepts that Crash Course introduces.

Climate Change and Context

For sake of simplicity[…], we’re going to focus on one type of pollution: carbon dioxide emissions. They’re one of the primary greenhouse gases. These greenhouse gases basically blanket the earth and are causing climate change. CO2 levels are the highest they’ve been for millions years which is why environmentalists consider it a “planetary emergency.”

There is without a doubt an enormous fervor about Climate Change (formerly known as “Global Warming”). Scientists from across the spectrum agree on the principles about how carbon dioxide affects the atmosphere, but there is disagreement on the how bad the earth’s situation is and what is likely to happen in the future. While your media source of choice might classify some beliefs as “denying” or “alarmist” about climate change, not many are talking about the real differences between the two scientific arguments. These arguments are not on economics, but I thought I’d give my two cents since Crash Course seems pretty confident in their point of view that it is a “planetary emergency”.

Scientists agree that increasing carbon dioxide emissions means an increase in temperature. This relationship is not doubted; however, what is argued is how much CO2 creates how much of an increase in temperature. The jury is still out on this one. So far, no one has been able to accurately predict the earth’s surface temperature year in and year out with predictive models, but people do have theories about how it is going to turn out. We know now that the climate models of the 90’s were wrong (remember Al Gore’s hockey stick graph?), but as for the current models, we’ll have to wait to find out.

Scientifically speaking, Crash Course’s claim that it is a “planetary emergency” is at least debatable, depending on which predictive model you’re using. But for the purposes of the rest of our analysis, we’re just going to assume that the goal is to reduce carbon emissions.

Rebound Effect

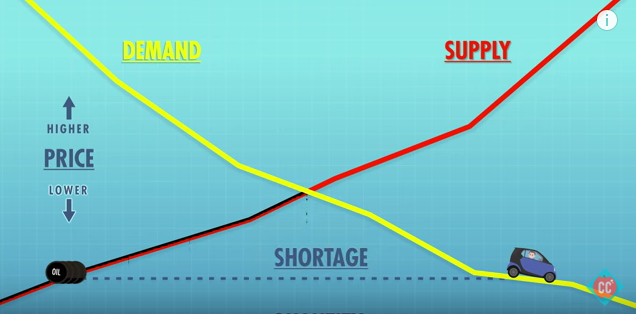

Let’s say Hank uses a gallon of gas to drive to work everyday. Then, partially to help the planet but mostly to help his wallet, he buys a new fuel efficient car that only takes half a gallon of gas for the same commute. He saves money and there’s less pollution. It is a win-win.

The rebound effect says that the benefits of energy efficiency might be reduced as people change their behavior. With the money he saves, Hank might start driving more than he normally would or he might go on a vacation in Hawaii. That leads to more consumption and possibly even more emissions.

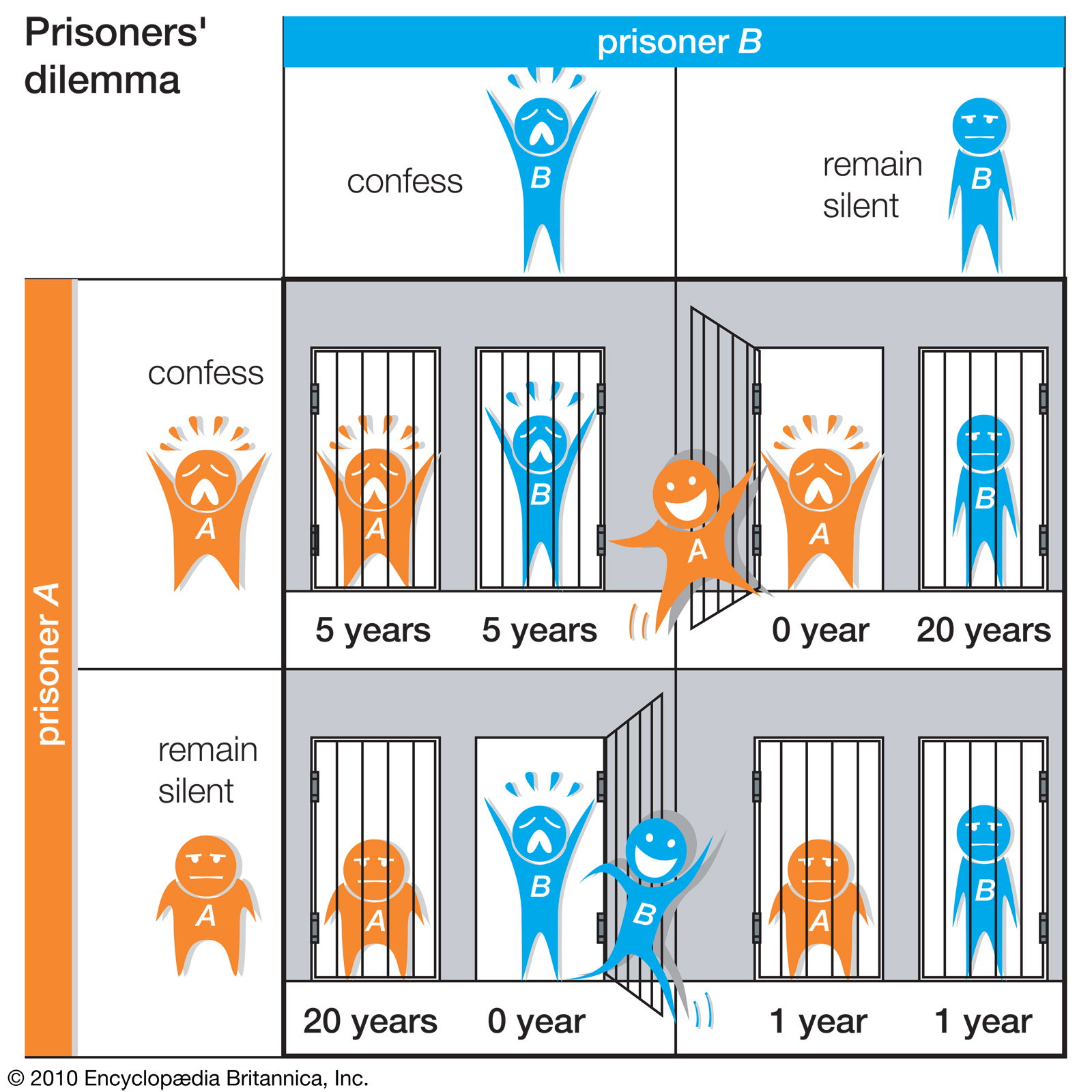

The moral that Crash Course derives here is that it is very difficult to predict human behavior. The entire financial sector trade trillions of dollars every day based on what they think humans will do, and many of them still get it wrong. Governments, believe it or not, have even less at stake if they get these predictions wrong, and they are more likely to overlook the rebound effects (although it does look good to be doing something).

However, let’s not forget that energy efficient vehicles actually do wonders for the economy in other, non-environmental ways. If Hank switches from a regular car to a hybrid, he is saving significant amounts of money which can later be spent on other consumer goods for himself. Hank’s standard of living increases, and this is the real beauty of fuel efficient cars.

Government Investment

Private companies and governments are also funding research into green technology. In the U.S. the American Recovery and Reinvestment Act of 2009 allocated billions to fund renewable energy.

This is a great point that Crash Course brings up, although they fail to comment on the potential downside of government investment into green technology. When free market economists think of the American Recovery and Reinvestment Act of 2009 in the field of green technologies, one company in particular comes to mind: Solyndra.

Solyndra received over half of a billion dollars in loan guarantees from the federal government as a part of this 2009 law. Two years later, the company filed for Chapter 11 bankruptcy and is being investigated by the FBI and the Treasury for accounting fraud. As it turns out, Solyndra was not a good investment. Remember my previous comment on governments not having much at stake when making these investment decisions?

I would have liked to see Crash Course comment on the potential economic downsides to government intervention. Besides possibly wasting taxpayer money on poor investments, government intervention into a market will necessarily distort it, and sometimes the efficient and productive companies get pushed out if the government chooses unwisely. To many economists, government intervention into any market (environmental or not) will do more harm than good for the consumers.

This week was a short one, but thanks for reading and be sure to come back every Thursday for a fresh post! And don’t forget to join our newsletter and our facebook group, and comment below!