If you’re a regular reader of this blog, you saw the title of the thirteenth episode and thought it was too good to be true. Economic Schools of Thought? This might be the most important episode yet!

Personally, I think it was, as it does put the entire Crash Course series into perspective. I was really impressed with this video, so I’m going to start with the good things first:

Feathers in Your Cap, Crash Course

You do care!

First, it appears that Crash Course reads the comments section of youtube, something I’ve advised against doing in general, but it’s nice to see that Crash Course cares about its fans and what they want to learn about. Can you imagine if public schools were like this?

People are Often Wrong

Crash Course mentioned how all popular theories in science could be proven wrong.:

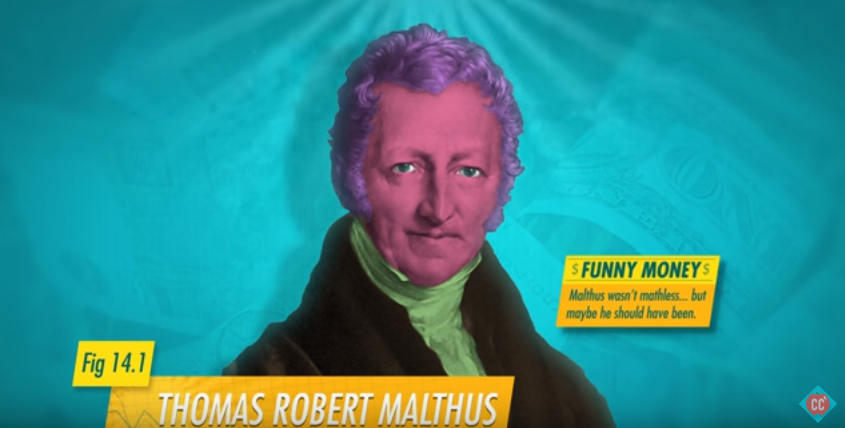

In 1798 British Economist Thomas Malthus argued that population growth will outpace food production, so eventually humans will run out of food […] Malthus was wrong, dismally wrong.

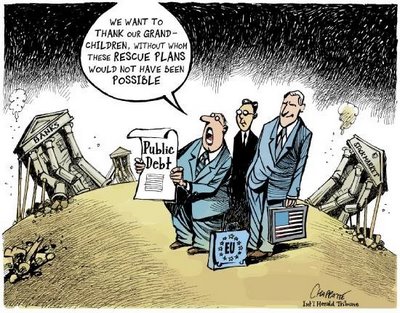

Economic theories are constantly being proven, disproven, and revised. The problem is , when these theories are wrong, millions of people can be adversely affected.

Here is where Crash Course could have thrown in how Malthus’s theory inspired some rather terrible political policies (eugenics). I don’t think the numbers were in the millions, though.

Again, Economics is not a Physical Science

Economics is not an exact science. It aims to draw conclusions about human behavior without the benefits of labs or perfect control groups. Economic theories reflect different attitudes about human nature, and those are likely to change over time.

Crash Course then goes through a the history of theories, including Communism and the Austrian School.

A Couple Critiques

I couldn’t let this episode go without pointing out a few (only a few though!) problems I had with the things said in the video.

The Great Depression crashed the market economies of the world’s richest countries. It also dealt a devastating blow to classical economics.

This is true; however, something needs to be said about Monetary Policy here. Certainly many people saw the Great Depression as evidence that the market doesn’t work, later schools of thought (The Austrian School and to a great extent, the Chicago School) explain the Great Depression was caused by increased government intervention into monetary policy.

Communists would probably say the same thing when Crash Course mentions how Communism failed. They would likely argue that it wasn’t communism that failed, it was just that these regimes didn’t implement it the right way (although I admit I’m less familiar with these arguments so I might not do them justice).

The Austrian School today argues that the economy is just too complicated to manipulate.

That sort of summarizes it, I suppose. I would say that the Austrian School argues that any artificial manipulations to the market (including the interest rate) create a less efficient economy that does not meet consumer needs as well as an economy free from intervention. Crash Course’s definition makes it seem like Austrians are economic agnostics.

Overall, this Crash Course video was fantastic. It introduced and explained (however briefly) different schools of economic thought, and more or less admitted that Crash Course teaches a specific school of thought, which combines Keynesianism and Classical Economics into something called New Neoclassical Synthesis. It’s almost like Crash Course admits that these videos are just, like, their opinion .