Crash Course’s episode this week deals with inflation and bubbles, and while they do a solid job on explaining how the CPI is calculated and the difference between nominal and real numbers, their explanation of the definition of inflation and causes of inflation were either misrepresented or not fully explained. Let’s start from the top:

What is Inflation?

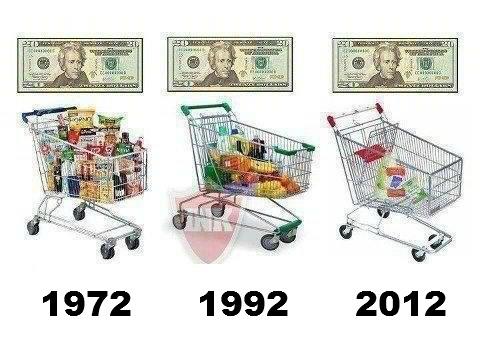

The first thing I noticed about this video is that they never really define what inflation is. Instead they start with the question “Why should we care?” and then explain how a reduction in your purchasing power limits the amount of stuff you can buy, so you should care.

This is probably the best time to note that there is a difference of opinion on what the definition of inflation is, and this debate is particularly between the Austrian School and everyone else. The Austrian School of economics defines inflation as an increase in the money supply (often referred to as “printing money”), while price inflation is when the prices of goods rise. Austrians get kind of nit-picky when people refer to inflation as an increase in the price of goods, as Crash Course does here, so I felt I needed to mention it.

As a personal view, I think a lot of time is wasted in debate talking about what the definition should be, so if people want to call the increase in prices inflation, I’m okay with it as long as we both use the term the same way. The more important conversation is what causes [price] inflation, why, and is it a good thing?

After explaining how inflation is calculated, the video identifies that there are really two types of inflation:

Demand Pull Inflation

They define this as “too much money chasing too few goods.”

Crash Course’s explains Demand Pull Inflation by saying:

If people have a lot of money, and they want to buy more stuff, they are going to bid up the prices for things, causing [demand pull] inflation.

This explanation of inflation is generally agreed upon between schools of economic thought, but it doesn’t fully explain what makes people have a lot of money.

Sometimes, but rarely, a whole town strikes it rich (which is more or less what is depicted in the Crash Course video). For example, some towns in North Dakota are now seeing prices rise because an oil field was discovered under the town, creating thousands of high-paying jobs. Since more people have more money to spend, prices in the town increase. But this rare scenario is not what most people consider to be inflation.

Inflation is generally thought of as prices increasing across the country, which means that both my local pizza shop and Amazon.com have increased their prices. This kind of inflation is caused by an expansion in the money supply, meaning that new US currency has been printed and is circulating throughout the country, bidding up the prices of all goods. Those who benefit most from inflation are the ones who get to touch the newly-printed money first before prices have risen (which are, generally speaking, investment banks), and those who suffer the most from inflation are those who touch the money last, as they usually get their wages increased only after prices have risen.

While Crash Course wasn’t wrong in their explanation, they did leave out the very important point of the origins of inflation, which they will hopefully cover in a future video.

Cost Push Inflation

Crash Course also includes a second type of inflation, which is referred to as Cost Push Inflation:

Another cause of inflation is the decrease in availability of an important productive resource, like oil or something. An oil shortage would increase the price of gasoline, increasing the cost of delivering flour, cheese, and pepperoni. This would increase the cost of producing pizza, therefore decreasing the number of pizzas that can be produced. Economists call this a supply shock and it causes something called cost push inflation.

Cost Push Inflation is actually a controversial subject between schools of economics, and Wikipedia even includes a section on its criticism.

The problem that some schools of economic thought have with this idea is that Cost Push Inflation essentially expands the definition of inflation beyond monetary policy. Since inflation is generally associated with interest rates, the money supply, and purchasing power, the term Cost Push Inflation conflates monetary policy and simple microeconomics.

The critics of the term Cost Push Inflation argue that natural disasters and other events that affect the price of goods should not be considered inflationary, since inflation is a term for monetary policy and affects consumers’ purchasing power, not just the price.

In other words, calling supply shortages “inflation” confuses the term. Inflation is something that is willfully created by controllers of the money supply (usually the Fed lowering interest rates or the practice of Quantitative Easing), as opposed to something that is caused by nature (Crash Course cites disease and drought as a potential cause of Cost Push Inflation).

Crash Course’s Definition versus Others’

Crash Course sums it up this way:

To keep it simple, inflation is caused by consumers bidding up the price of stuff or producers raising prices and producing less because there’s an increase in production cost.

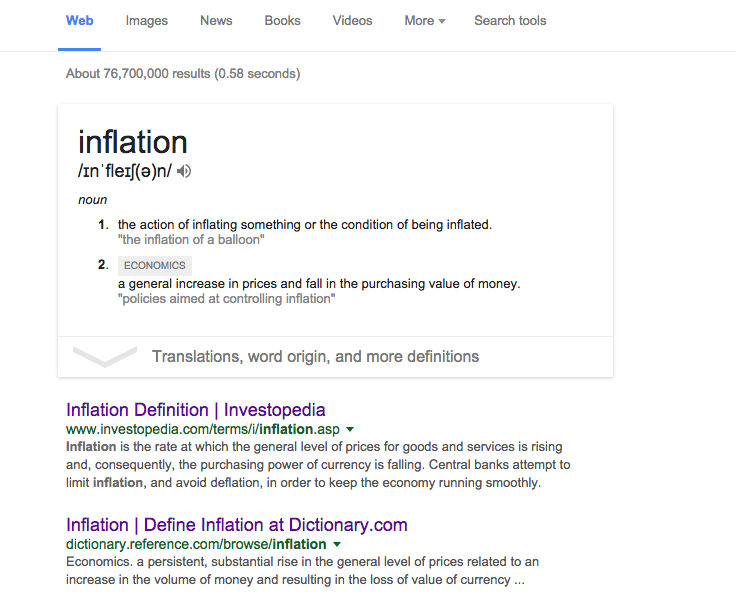

As I mentioned before, this is a controversial definition of inflation between economic schools of thought, but let’s look at the most cited definitions of inflation. Let’s look at the top three google results for the definition of inflation:

From Google’s dictionary: “A general increase in prices and fall in the purchasing value of money”

From Investopedia: “Inflation is the rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling.”

From Dictionary.com: “a persistent, substantial rise in the general level of prices related to an increase in the volume of money and resulting in theloss of value of currency.”

I would understand if Crash Course were following the most widely-used definition of inflation, or stated that there is debate over the proper definition, but instead they chose a definition from a particular school of thought and stated it as fact.

Like what I wrote? Hate it? Drop your thoughts in the comments.